Records Retention Policy Template - Tax records should be retained for at least six years from the date of filing the applicable return. The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. It ensures data accuracy, security, and compliance with legal. A record retention policy provides a framework for creating, storing, and accessing company records.

Record retention policy template in Word and Pdf formats page 2 of 3

The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. Tax records should be retained for at least six years from.

Academic Records Retention Policy Template in Word, PDF, Google Docs Download

It ensures data accuracy, security, and compliance with legal. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. The purpose.

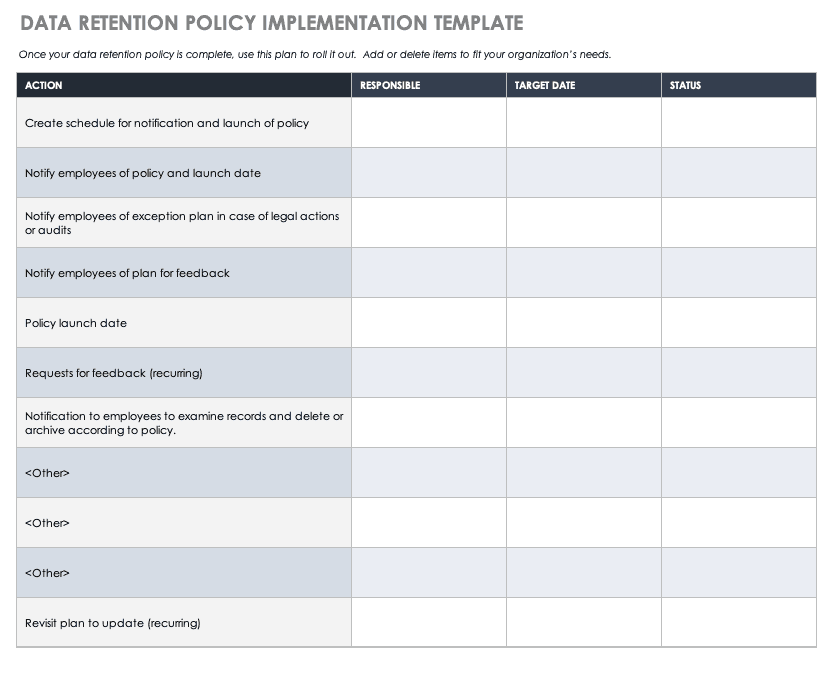

How to Create a Data Retention Policy Smartsheet

The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. Tax records should be retained for at least six years from the date of filing the applicable return. The purpose of this policy statement is to allow association to identify, retain, store, and dispose.

Record retention policy template in Word and Pdf formats

The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. A record retention policy provides a framework for creating, storing, and accessing company records. Tax records should be retained for at least six years from the date of filing the applicable return. This record retention policy aligns.

Document Retention Policy download free documents for PDF, Word and Excel

A record retention policy provides a framework for creating, storing, and accessing company records. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. It ensures data accuracy, security, and compliance with legal. The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained.

How to Create a Data Retention Policy Smartsheet

It ensures data accuracy, security, and compliance with legal. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. A record retention policy provides a framework for creating, storing,.

How to Create a Data Retention Policy Smartsheet

A record retention policy provides a framework for creating, storing, and accessing company records. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. It ensures data accuracy, security, and compliance with legal. Tax records should be retained for at least six years from the date of.

Data Retention Policy Template

Tax records should be retained for at least six years from the date of filing the applicable return. It ensures data accuracy, security, and compliance with legal. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. This record retention policy aligns the firm’s.

Document Retention Policy download free documents for PDF, Word and Excel

The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional.

Academic Records Retention Policy Template in Word, PDF, Google Docs Download

A record retention policy provides a framework for creating, storing, and accessing company records. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. Tax records should be retained for at least six years from the date of filing the applicable return. The human resources (hr) department retains and destroys personnel records.

Tax records should be retained for at least six years from the date of filing the applicable return. The purpose of this policy statement is to allow association to identify, retain, store, and dispose of the association’s records in an appropriate,. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. A record retention policy provides a framework for creating, storing, and accessing company records. The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to. The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. It ensures data accuracy, security, and compliance with legal.

The Purpose Of This Policy Statement Is To Allow Association To Identify, Retain, Store, And Dispose Of The Association’s Records In An Appropriate,.

The human resources (hr) department retains and destroys personnel records in accordance with [company name's] corporate policies on business records retention, as well as federal and. This record retention policy aligns the firm’s dual goals of retaining records that materially support professional reports or. It ensures data accuracy, security, and compliance with legal. Tax records should be retained for at least six years from the date of filing the applicable return.

A Record Retention Policy Provides A Framework For Creating, Storing, And Accessing Company Records.

The purpose of this policy is to ensure that necessary records and documents of are adequately protected and maintained and to.